# Load required packages

library(tidyverse) # for data manipulation and plotting

library(readxl) # for reading Excel files

library(writexl) # for writing Excel files

library(glue) # for string formattingProject 1 Live Demo: Current Account Dynamics (GMD Data)

Follow-along Quarto doc (Positron + Copilot + R)

🎯 Goal for today

By the end of this demo, everyone will be able to:

- Open a Quarto document in Positron

- Run R code step-by-step (chunk-by-chunk)

- Use GitHub Copilot to speed up coding (without turning off your brain)

- Load, clean, and analyze the GMD Excel dataset used in Project 1

- Render this document into an HTML report you can submit/share

.qmd

GMD_sub_1995_2019.xlsx(the dataset used in Project 1)- This file:

proj1-gmd-live-demo.qmd

# Preview while editing (auto-refreshes)

quarto preview proj1-gmd-live-demo.qmd

# Render to HTML (creates .html file)

quarto render proj1-gmd-live-demo.qmd --to html

# Render to PDF (needs LaTeX)

quarto render proj1-gmd-live-demo.qmd --to pdf- Open this file in Positron

- Click on any code chunk

- Press

Ctrl+Enter(Windows/Linux) orCmd+Enter(Mac) to run that chunk - Watch the output appear below the chunk

- Move to next chunk and repeat

Step 1 — Install/Load Packages

Run this chunk FIRST. If you get errors, you may need to install packages first.

Type this comment in a code chunk and press Tab or Ctrl+I:

Copilot will suggest code to auto-install missing packages!

Step 2 — Student Inputs (EDIT THESE!)

👉 Students: Change these three variables for YOUR project

# CHANGE THESE VALUES FOR YOUR PROJECT

my_country <- "Thailand" # Pick from list below

start_date <- 2000 # Earliest: 1995

end_date <- 2019 # Latest: 2019 (2018 for Ireland/Mexico)

data_file <- "GMD_sub_1995_2019.xlsx"“Argentina”, “Australia”, “Brazil”, “Chile”, “Colombia”, “Costa Rica”, “Hungary”, “Iceland”, “Indonesia”, “Ireland” (2018), “Malaysia”, “Mexico” (2018), “New Zealand”, “Peru”, “Philippines”, “Poland”, “South Africa”, “South Korea”, “Sri Lanka”, “Thailand”

Demo countries: “Canada”, “United Kingdom”, “United States”

# Check if data file exists

if (!file.exists(data_file)) {

stop(glue(

"❌ Cannot find `{data_file}` in the current folder.\n",

"Fix: Put the Excel file in the same folder as this .qmd, then re-run."

))

} else {

glue("✅ Found data file: {data_file}")

}✅ Found data file: GMD_sub_1995_2019.xlsxStep 3 — Read and Filter Data

This loads the Excel file and filters it to your chosen country and years.

Proj1 <- read_excel(data_file) %>%

filter(year >= start_date, year <= end_date) %>%

filter(countryname == my_country)

# Show first few rows

head(Proj1)# A tibble: 6 × 52

countryname ISO3 year nGDP rGDP rGDP_pc rGDP_USD deflator cons rcons

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 Thailand THA 2000 5069820 5.25e6 83465. 221243. 96.5 3.43e6 3.57e6

2 Thailand THA 2001 5345001 5.44e6 85544. 228863. 98.3 3.71e6 3.76e6

3 Thailand THA 2002 5769578 5.77e6 90053. 242936. 100. 3.97e6 3.97e6

4 Thailand THA 2003 6317303 6.18e6 95807. 260401. 102. 4.33e6 4.25e6

5 Thailand THA 2004 6954282 6.57e6 101136. 276779. 106. 4.80e6 4.53e6

6 Thailand THA 2005 7614411 6.85e6 104693. 288369 111. 5.29e6 4.76e6

# ℹ 42 more variables: cons_GDP <dbl>, inv <dbl>, inv_GDP <dbl>, finv <dbl>,

# finv_GDP <dbl>, exports <dbl>, exports_GDP <dbl>, imports <dbl>,

# imports_GDP <dbl>, CA <dbl>, CA_GDP <dbl>, USDfx <dbl>, REER <dbl>,

# govexp <dbl>, govexp_GDP <dbl>, govrev <dbl>, govrev_GDP <dbl>,

# govtax <dbl>, govtax_GDP <dbl>, govdef <dbl>, govdef_GDP <dbl>,

# govdebt <dbl>, govdebt_GDP <dbl>, HPI <lgl>, CPI <dbl>, infl <dbl>,

# pop <dbl>, unemp <dbl>, strate <dbl>, ltrate <dbl>, cbrate <dbl>, …# Quick data check

Proj1 %>%

summarise(

country = first(countryname),

min_year = min(year, na.rm = TRUE),

max_year = max(year, na.rm = TRUE),

n_rows = n(),

n_columns = ncol(.)

) %>%

knitr::kable(caption = "Data Summary")| country | min_year | max_year | n_rows | n_columns |

|---|---|---|---|---|

| Thailand | 2000 | 2019 | 20 | 52 |

That means: - Country name doesn’t match exactly (check spelling/capitalization) - Year range is outside available data - Data file is wrong/corrupted

PART ONE: Basic Macro and Current Account Dynamics

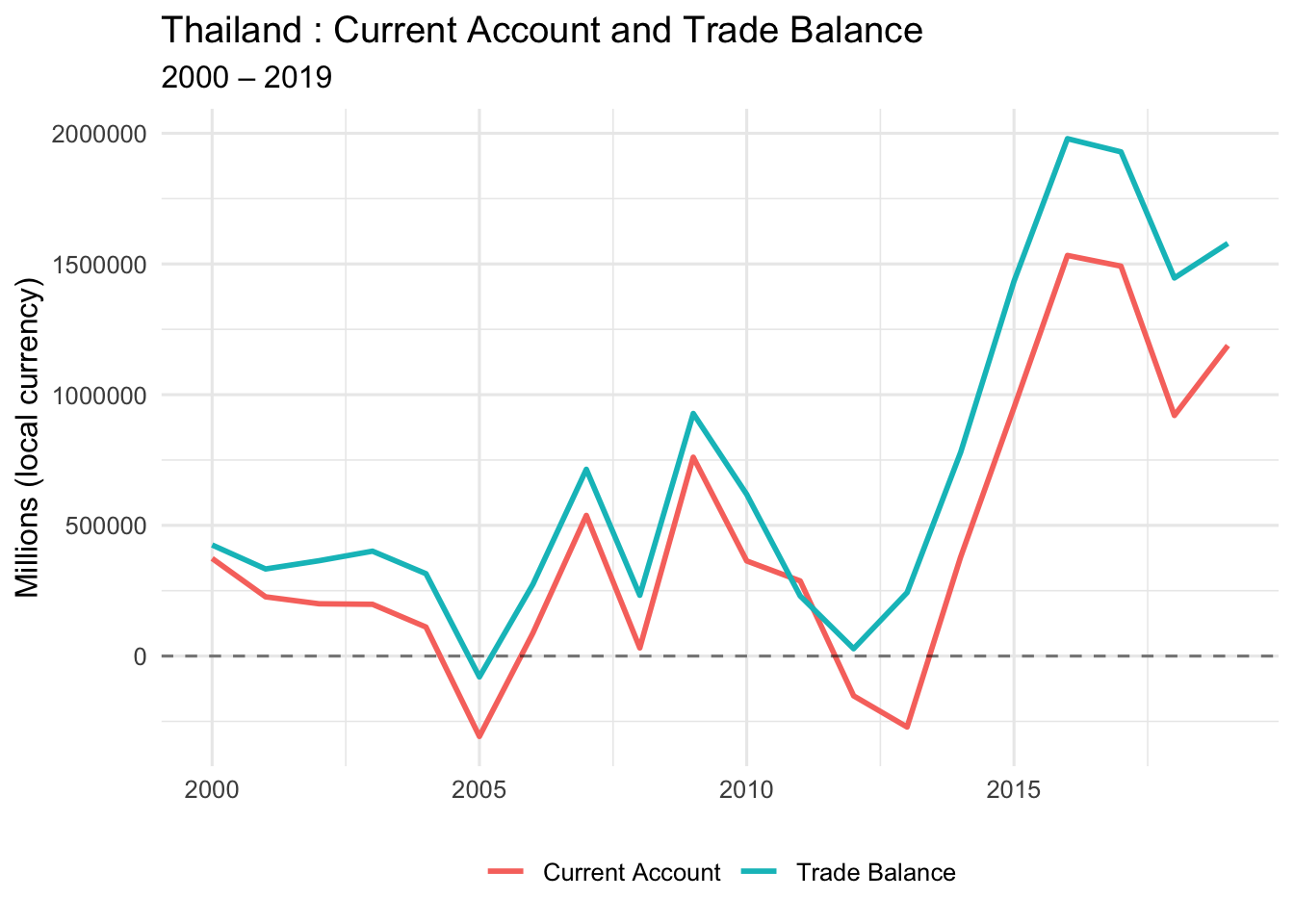

1A. Current Account vs Trade Balance (Time Series)

Theory: Current Account (CA) = Trade Balance (TB) + Income Balance (IB)

Let’s plot CA and TB together to see how closely they move.

ggplot(Proj1, aes(x = year)) +

geom_line(aes(y = CA, color = "Current Account"), linewidth = 1) +

geom_line(aes(y = trade_balance, color = "Trade Balance"), linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

labs(

title = paste(my_country, ": Current Account and Trade Balance"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = "Millions (local currency)",

color = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "bottom")

- Do CA and TB move together?

- Are they close in value?

- When do they diverge?

- Are both positive, both negative, or mixed?

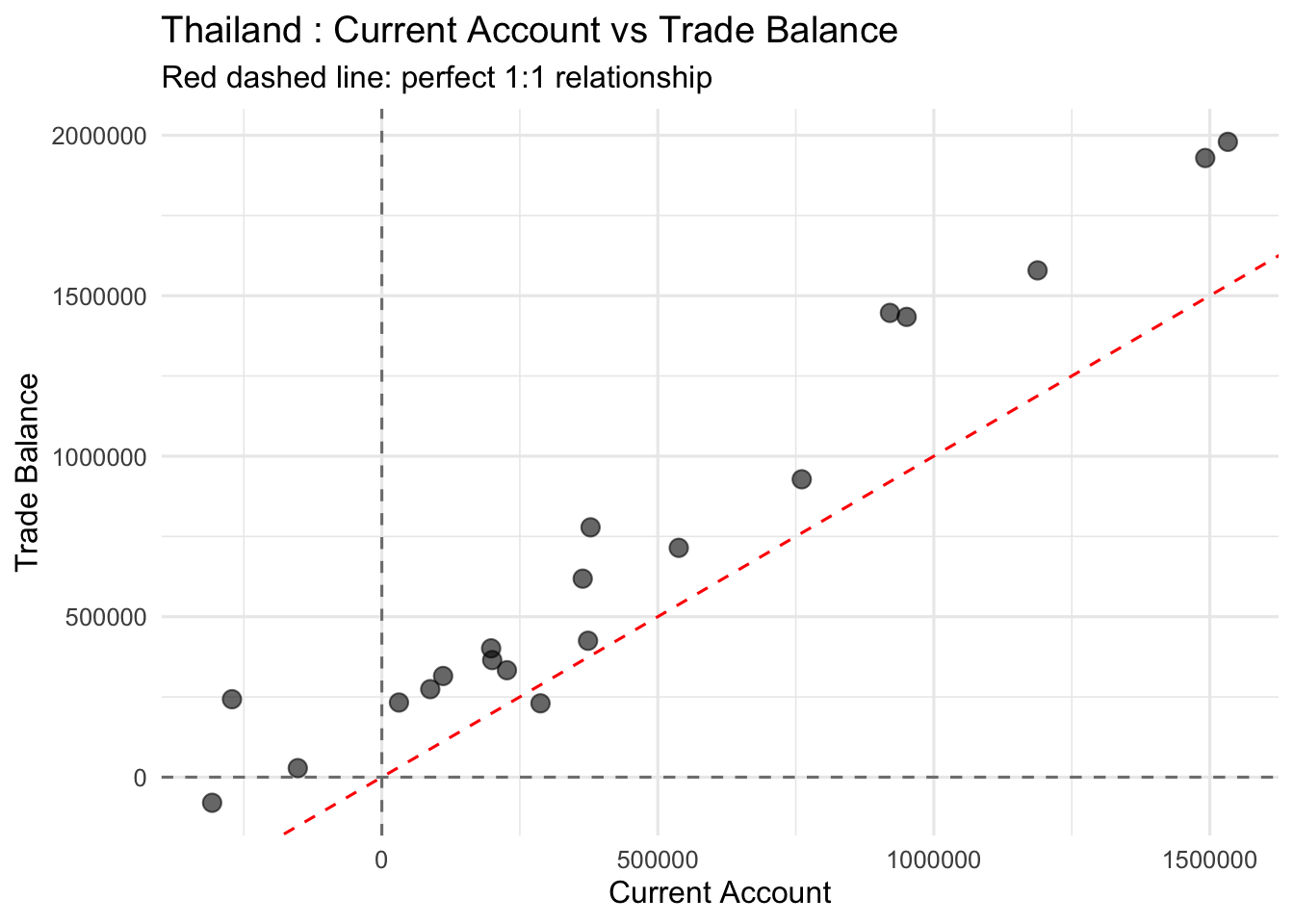

1B. Current Account vs Trade Balance (Scatter Plot)

This shows the relationship between CA and TB more clearly.

ggplot(Proj1, aes(x = CA, y = trade_balance)) +

geom_point(size = 3, alpha = 0.6) +

geom_hline(yintercept = 0, linetype = "dashed", color = "gray50") +

geom_vline(xintercept = 0, linetype = "dashed", color = "gray50") +

geom_abline(intercept = 0, slope = 1, linetype = "dashed", color = "red") +

labs(

title = paste(my_country, ": Current Account vs Trade Balance"),

subtitle = "Red dashed line: perfect 1:1 relationship",

x = "Current Account",

y = "Trade Balance"

) +

theme_minimal(base_size = 12)

- Points on red line: CA = TB (no income balance)

- Points above red line: TB > CA (negative income balance)

- Points below red line: CA > TB (positive income balance)

1C. Correlation Between CA and TB

Calculate the correlation coefficient to quantify the relationship.

cor_CA_TB <- cor(

x = Proj1$CA,

y = Proj1$trade_balance,

method = "pearson",

use = "complete.obs"

)

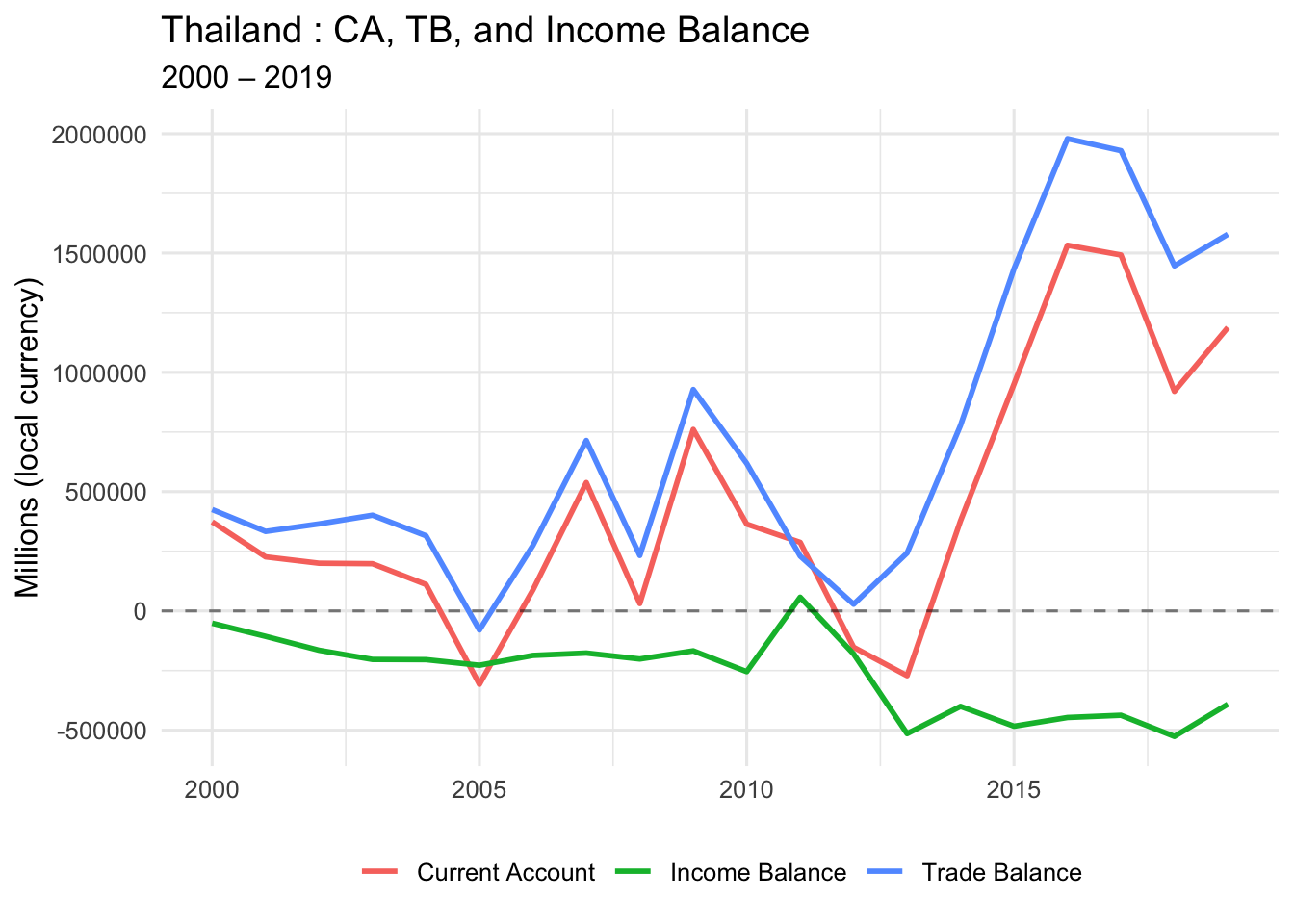

glue("Correlation (CA, TB) = {round(cor_CA_TB, 4)}")Correlation (CA, TB) = 0.9735# Explain why the correlation between CA and TB is close to but not exactly 11D. Calculate Income Balance

Income Balance = CA − TB

This represents net income from foreign assets (interest, dividends, etc.)

Proj1 <- Proj1 %>%

mutate(income_balance = CA - trade_balance)

# Show summary statistics

Proj1 %>%

summarise(

mean_IB = mean(income_balance, na.rm = TRUE),

median_IB = median(income_balance, na.rm = TRUE),

min_IB = min(income_balance, na.rm = TRUE),

max_IB = max(income_balance, na.rm = TRUE)

) %>%

knitr::kable(digits = 2, caption = "Income Balance Summary Statistics")| mean_IB | median_IB | min_IB | max_IB |

|---|---|---|---|

| -263275.2 | -203737.7 | -525965.6 | 57392.56 |

1E. Plot All Three: CA, TB, and Income Balance

ggplot(Proj1, aes(x = year)) +

geom_line(aes(y = CA, color = "Current Account"), linewidth = 1) +

geom_line(aes(y = trade_balance, color = "Trade Balance"), linewidth = 1) +

geom_line(aes(y = income_balance, color = "Income Balance"), linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

labs(

title = paste(my_country, ": CA, TB, and Income Balance"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = "Millions (local currency)",

color = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "bottom")

Q: What explains the difference between CA and TB?

A: Income Balance (r × B), which represents international asset earnings/payments

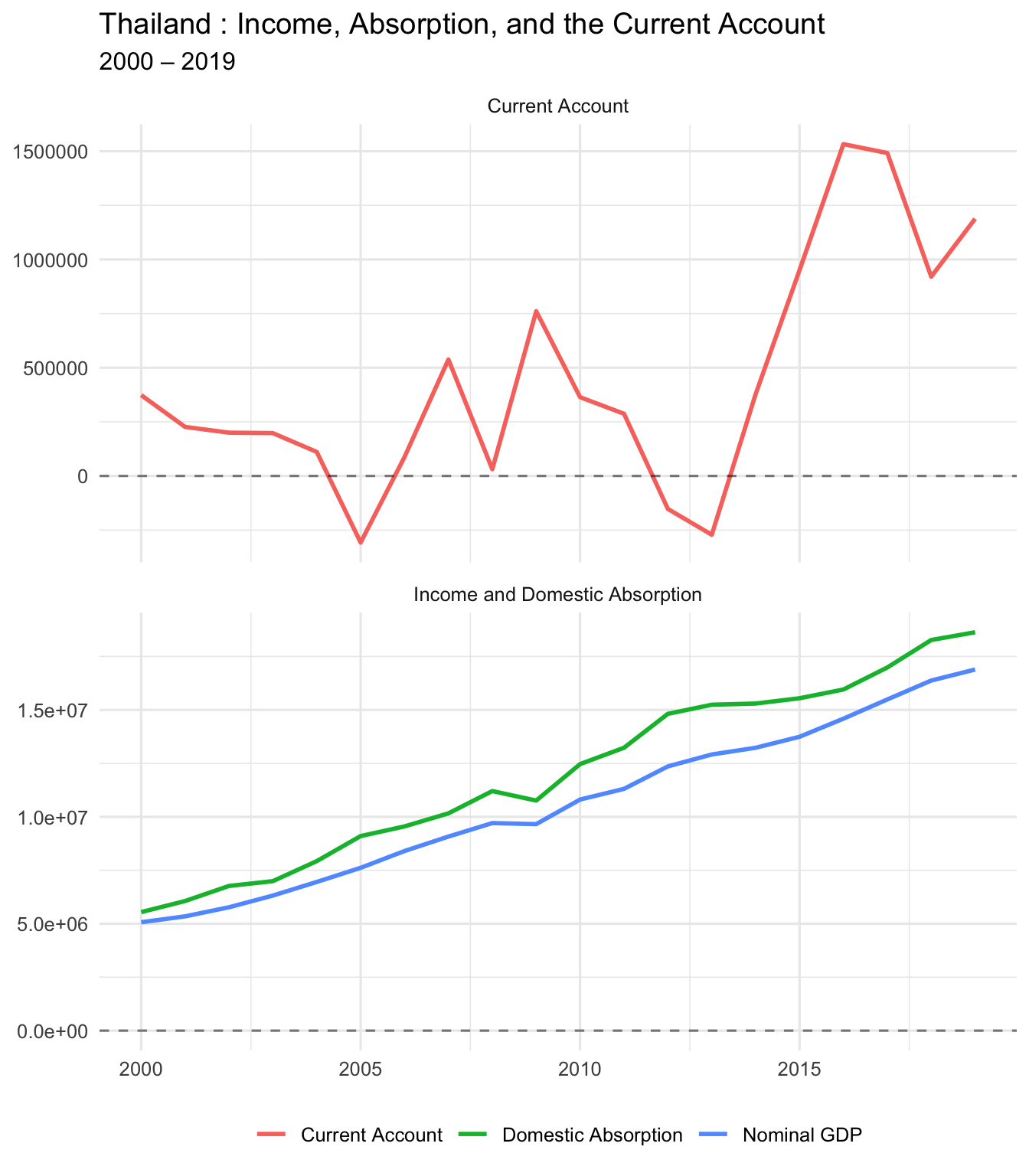

PART TWO: Absorption Approach (GDP vs Domestic Absorption)

2A. Calculate Domestic Absorption

Domestic Absorption = C + I + G

This is total domestic spending (consumption + investment + government).

Proj1 <- Proj1 %>%

mutate(dom_abs = cons + inv + govexp)

# Quick check

Proj1 %>%

select(year, nGDP, dom_abs, CA) %>%

head() %>%

knitr::kable(digits = 0, caption = "GDP, Absorption, and CA (first 6 years)")| year | nGDP | dom_abs | CA |

|---|---|---|---|

| 2000 | 5069820 | 5543275 | 373544 |

| 2001 | 5345001 | 6061942 | 226628 |

| 2002 | 5769578 | 6766900 | 199974 |

| 2003 | 6317303 | 6991474 | 197984 |

| 2004 | 6954282 | 7927919 | 110990 |

| 2005 | 7614411 | 9098803 | -307470 |

CA = GDP − (C + I + G)

Or equivalently: CA = GDP − Domestic Absorption

- When absorption > GDP → CA is negative (borrowing)

- When GDP > absorption → CA is positive (lending)

2B. Plot GDP, Absorption, and CA (Faceted)

Proj1_long_abs <- Proj1 %>%

select(year, nGDP, dom_abs, CA) %>%

pivot_longer(

cols = c(nGDP, dom_abs, CA),

names_to = "variable",

values_to = "value"

) %>%

mutate(

panel = case_when(

variable %in% c("nGDP", "dom_abs") ~ "Income and Domestic Absorption",

variable == "CA" ~ "Current Account"

),

variable = recode(

variable,

nGDP = "Nominal GDP",

dom_abs = "Domestic Absorption",

CA = "Current Account"

)

)

ggplot(Proj1_long_abs, aes(x = year, y = value, color = variable)) +

geom_line(linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

facet_wrap(~ panel, ncol = 1, scales = "free_y") +

labs(

title = paste(my_country, ": Income, Absorption, and the Current Account"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = NULL,

color = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "bottom")

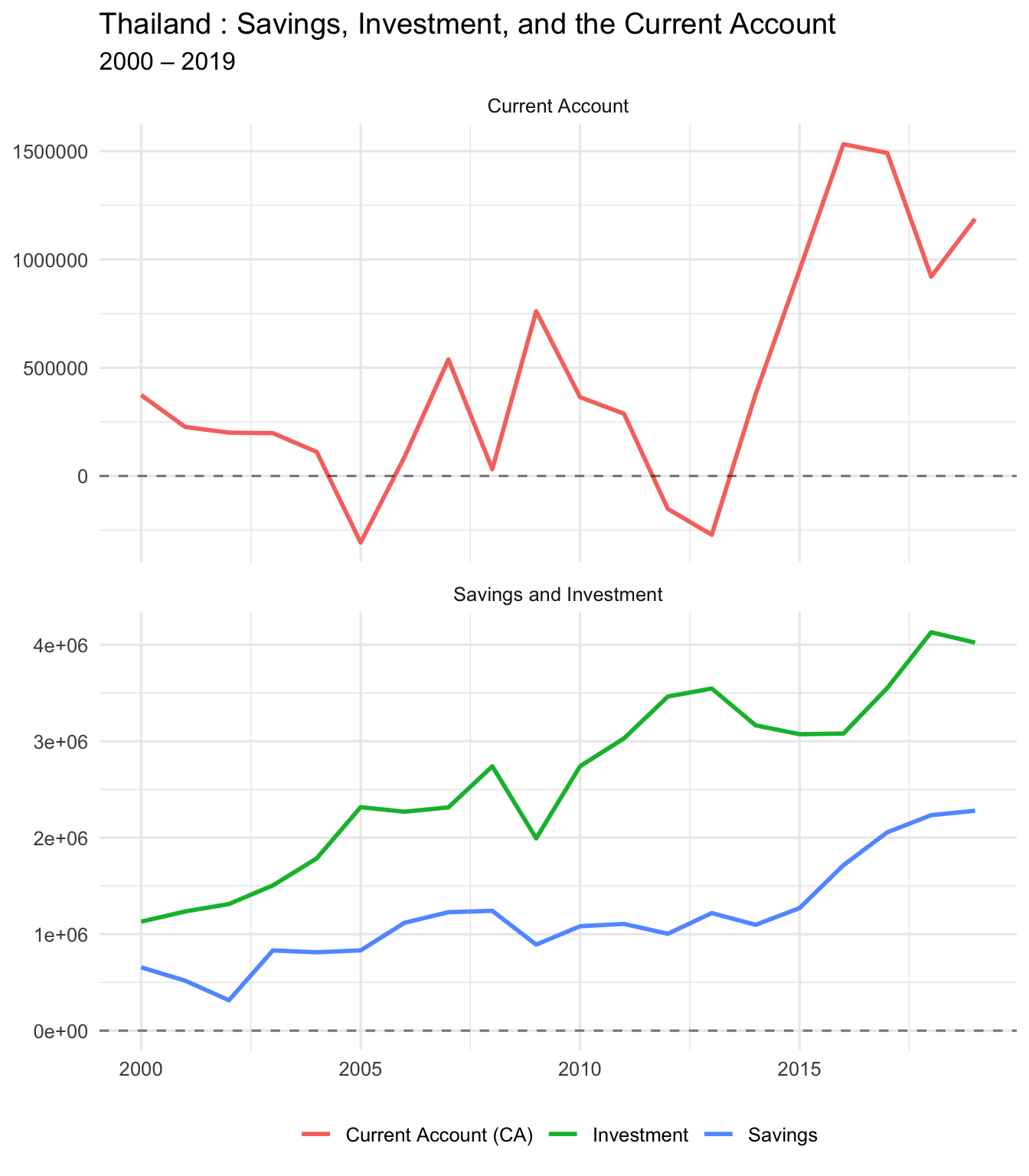

# Write a paragraph explaining what it means when domestic absorption exceeds GDPPART THREE: Savings-Investment Approach

3A. Calculate National Savings

National Savings = GDP − C − G

(We subtract consumption and government spending from GDP)

Proj1 <- Proj1 %>%

mutate(savings = nGDP - (cons + govexp))

# Summary stats

Proj1 %>%

summarise(

mean_savings = mean(savings, na.rm = TRUE),

mean_investment = mean(inv, na.rm = TRUE),

mean_CA = mean(CA, na.rm = TRUE)

) %>%

knitr::kable(digits = 0, caption = "Average Savings, Investment, and CA")| mean_savings | mean_investment | mean_CA |

|---|---|---|

| 1175354 | 2620013 | 445426 |

CA = S − I

- When S > I → CA positive (country is lending/saving abroad)

- When I > S → CA negative (country is borrowing to invest)

3B. Plot Savings, Investment, and CA

Proj1_sav_inv_long <- Proj1 %>%

select(year, savings, inv, CA) %>%

pivot_longer(

cols = c(savings, inv, CA),

names_to = "variable",

values_to = "value"

) %>%

mutate(

panel = if_else(variable == "CA", "Current Account", "Savings and Investment"),

variable = recode(

variable,

savings = "Savings",

inv = "Investment",

CA = "Current Account (CA)"

)

)

ggplot(Proj1_sav_inv_long, aes(x = year, y = value, color = variable)) +

geom_line(linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

facet_wrap(~ panel, ncol = 1, scales = "free_y") +

labs(

title = paste(my_country, ": Savings, Investment, and the Current Account"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = NULL,

color = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "bottom")

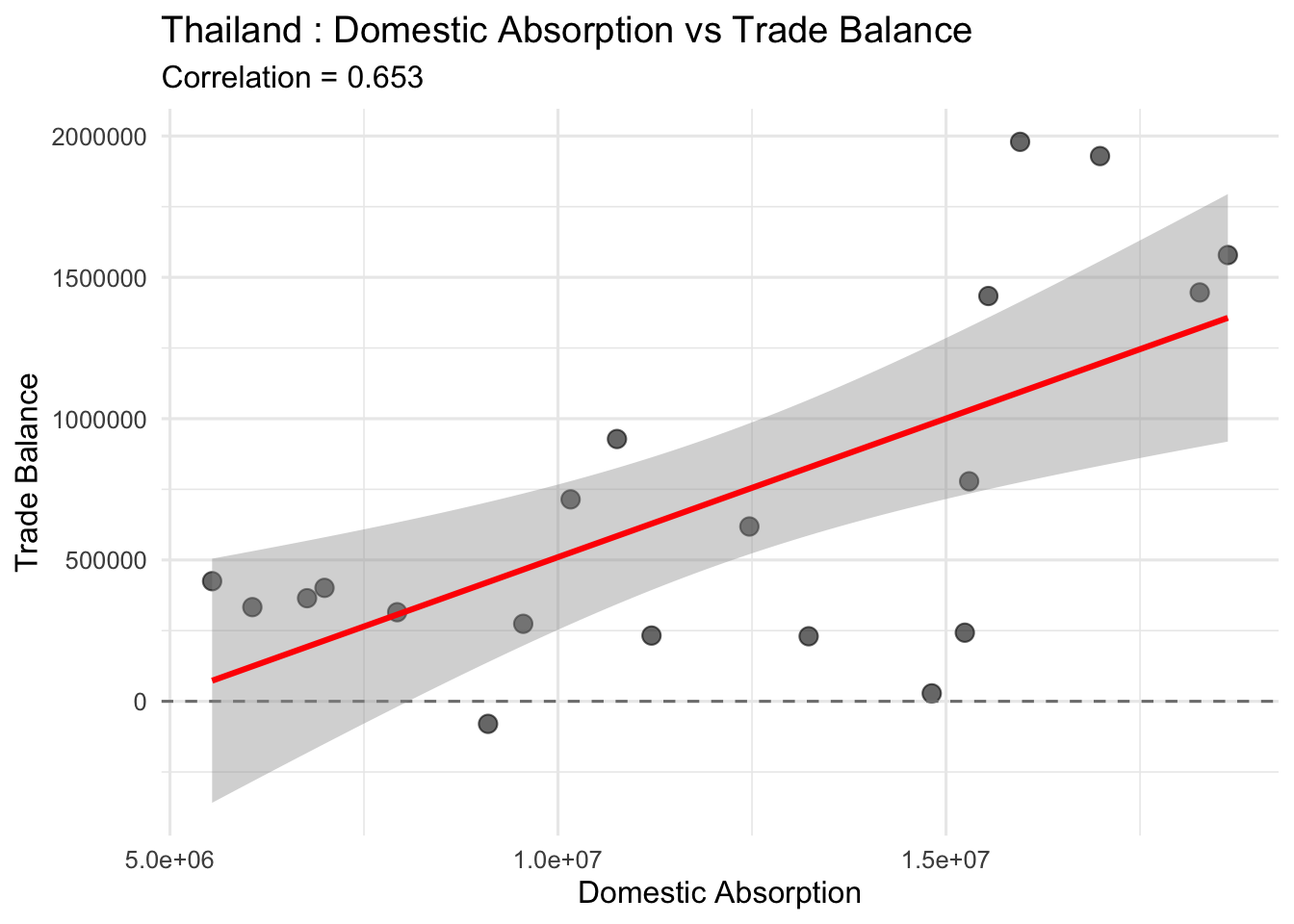

PART FOUR: Business Cycle Correlations

4A. Correlation Matrix

Let’s see how GDP, absorption, and trade balance move together.

cor_matrix <- Proj1 %>%

select(nGDP, dom_abs, trade_balance, CA) %>%

cor(use = "complete.obs")

cor_matrix %>%

knitr::kable(digits = 3, caption = "Correlation Matrix")| nGDP | dom_abs | trade_balance | CA | |

|---|---|---|---|---|

| nGDP | 1.000 | 0.996 | 0.712 | 0.610 |

| dom_abs | 0.996 | 1.000 | 0.653 | 0.544 |

| trade_balance | 0.712 | 0.653 | 1.000 | 0.973 |

| CA | 0.610 | 0.544 | 0.973 | 1.000 |

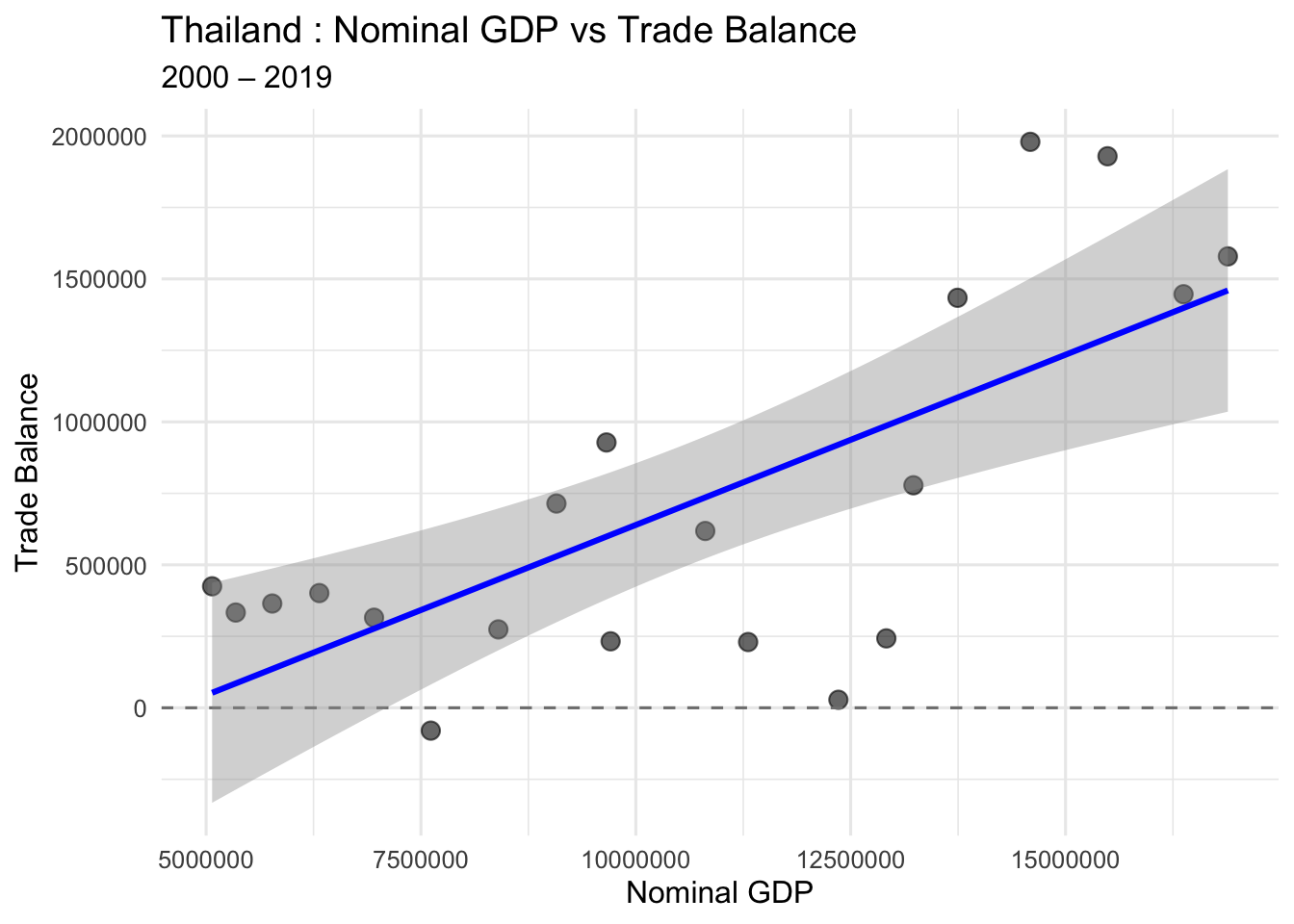

4B. GDP vs Trade Balance

cor_gdp_tb <- cor(Proj1$nGDP, Proj1$trade_balance, use = "complete.obs")

cor_gdp_ca <- cor(Proj1$nGDP, Proj1$CA, use = "complete.obs")

glue("Correlation (GDP, TB) = {round(cor_gdp_tb, 4)}")Correlation (GDP, TB) = 0.7122glue("Correlation (GDP, CA) = {round(cor_gdp_ca, 4)}")Correlation (GDP, CA) = 0.6096- Negative correlation: Trade balance/CA moves opposite to GDP (counter-cyclical)

- Positive correlation: Trade balance/CA moves with GDP (pro-cyclical)

4C. Scatter: GDP vs Trade Balance

ggplot(Proj1, aes(x = nGDP, y = trade_balance)) +

geom_point(size = 3, alpha = 0.6) +

geom_hline(yintercept = 0, linetype = "dashed", color = "gray50") +

geom_smooth(method = "lm", se = TRUE, color = "blue") +

labs(

title = paste(my_country, ": Nominal GDP vs Trade Balance"),

subtitle = paste(start_date, "–", end_date),

x = "Nominal GDP",

y = "Trade Balance"

) +

theme_minimal(base_size = 12)

4D. Scatter: Domestic Absorption vs Trade Balance

cor_abs_tb <- cor(Proj1$dom_abs, Proj1$trade_balance, use = "complete.obs")

ggplot(Proj1, aes(x = dom_abs, y = trade_balance)) +

geom_point(size = 3, alpha = 0.6) +

geom_hline(yintercept = 0, linetype = "dashed", color = "gray50") +

geom_smooth(method = "lm", se = TRUE, color = "red") +

labs(

title = paste(my_country, ": Domestic Absorption vs Trade Balance"),

subtitle = glue("Correlation = {round(cor_abs_tb, 3)}"),

x = "Domestic Absorption",

y = "Trade Balance"

) +

theme_minimal(base_size = 12)

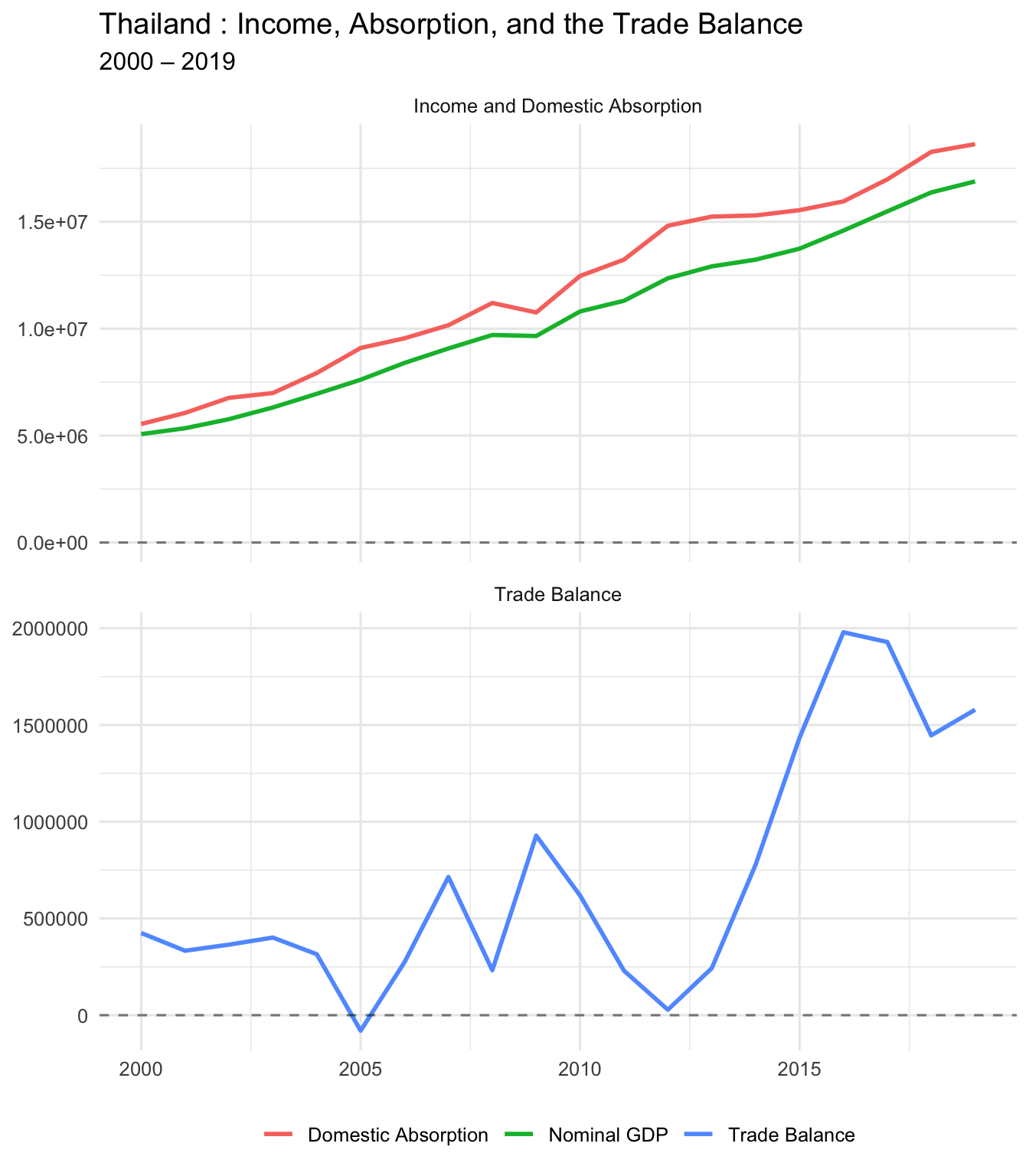

4E. Time Series: GDP, Absorption, and TB

Proj1_long_cyc <- Proj1 %>%

select(year, nGDP, dom_abs, trade_balance) %>%

pivot_longer(

cols = c(nGDP, dom_abs, trade_balance),

names_to = "variable",

values_to = "value"

) %>%

mutate(

panel = case_when(

variable %in% c("nGDP", "dom_abs") ~ "Income and Domestic Absorption",

variable == "trade_balance" ~ "Trade Balance"

),

variable = recode(

variable,

nGDP = "Nominal GDP",

dom_abs = "Domestic Absorption",

trade_balance = "Trade Balance"

)

)

ggplot(Proj1_long_cyc, aes(x = year, y = value, color = variable)) +

geom_line(linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

facet_wrap(~ panel, ncol = 1, scales = "free_y") +

labs(

title = paste(my_country, ": Income, Absorption, and the Trade Balance"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = NULL,

color = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "bottom")

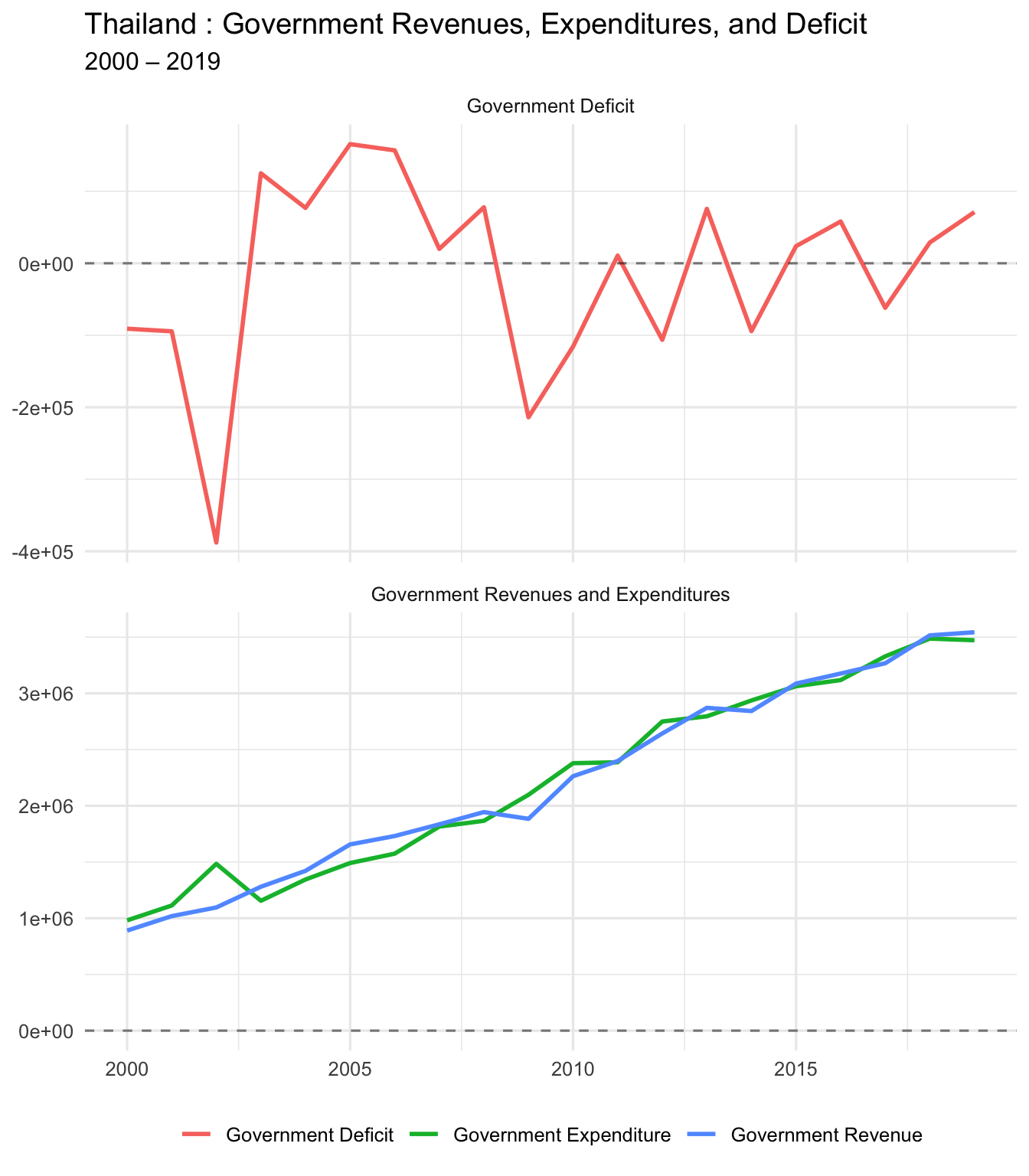

PART FIVE: Government Balance

5A. Government Revenues, Expenditures, and Deficit

Proj1_gov_long <- Proj1 %>%

select(year, govrev, govexp, govdef) %>%

pivot_longer(

cols = c(govrev, govexp, govdef),

names_to = "variable",

values_to = "value"

) %>%

mutate(

panel = if_else(variable == "govdef",

"Government Deficit",

"Government Revenues and Expenditures"),

variable = recode(

variable,

govrev = "Government Revenue",

govexp = "Government Expenditure",

govdef = "Government Deficit"

)

)

ggplot(Proj1_gov_long, aes(x = year, y = value, color = variable)) +

geom_line(linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

facet_wrap(~ panel, ncol = 1, scales = "free_y") +

labs(

title = paste(my_country, ": Government Revenues, Expenditures, and Deficit"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = NULL,

color = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "bottom")

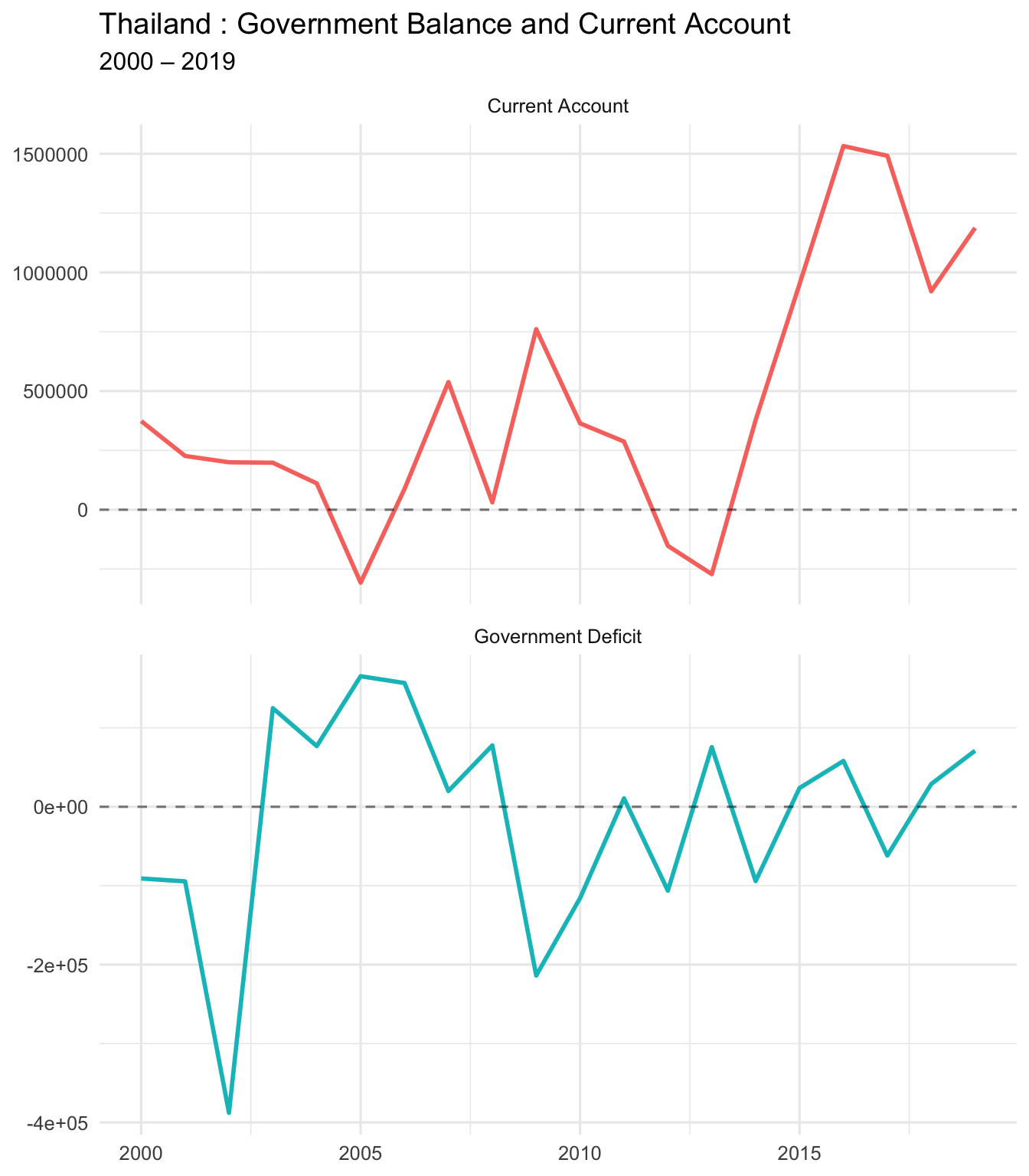

5B. Government Deficit and Current Account

Are “twin deficits” present? (Government deficit and CA deficit moving together)

Proj1_govdef_ca_long <- Proj1 %>%

select(year, govdef, CA) %>%

pivot_longer(

cols = c(govdef, CA),

names_to = "variable",

values_to = "value"

) %>%

mutate(

variable = recode(

variable,

govdef = "Government Deficit",

CA = "Current Account"

)

)

ggplot(Proj1_govdef_ca_long, aes(x = year, y = value, color = variable)) +

geom_line(linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

facet_wrap(~ variable, ncol = 1, scales = "free_y") +

labs(

title = paste(my_country, ": Government Balance and Current Account"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = NULL

) +

theme_minimal(base_size = 12) +

theme(legend.position = "none")

cor_govdef_ca <- cor(Proj1$govdef, Proj1$CA, use = "complete.obs")

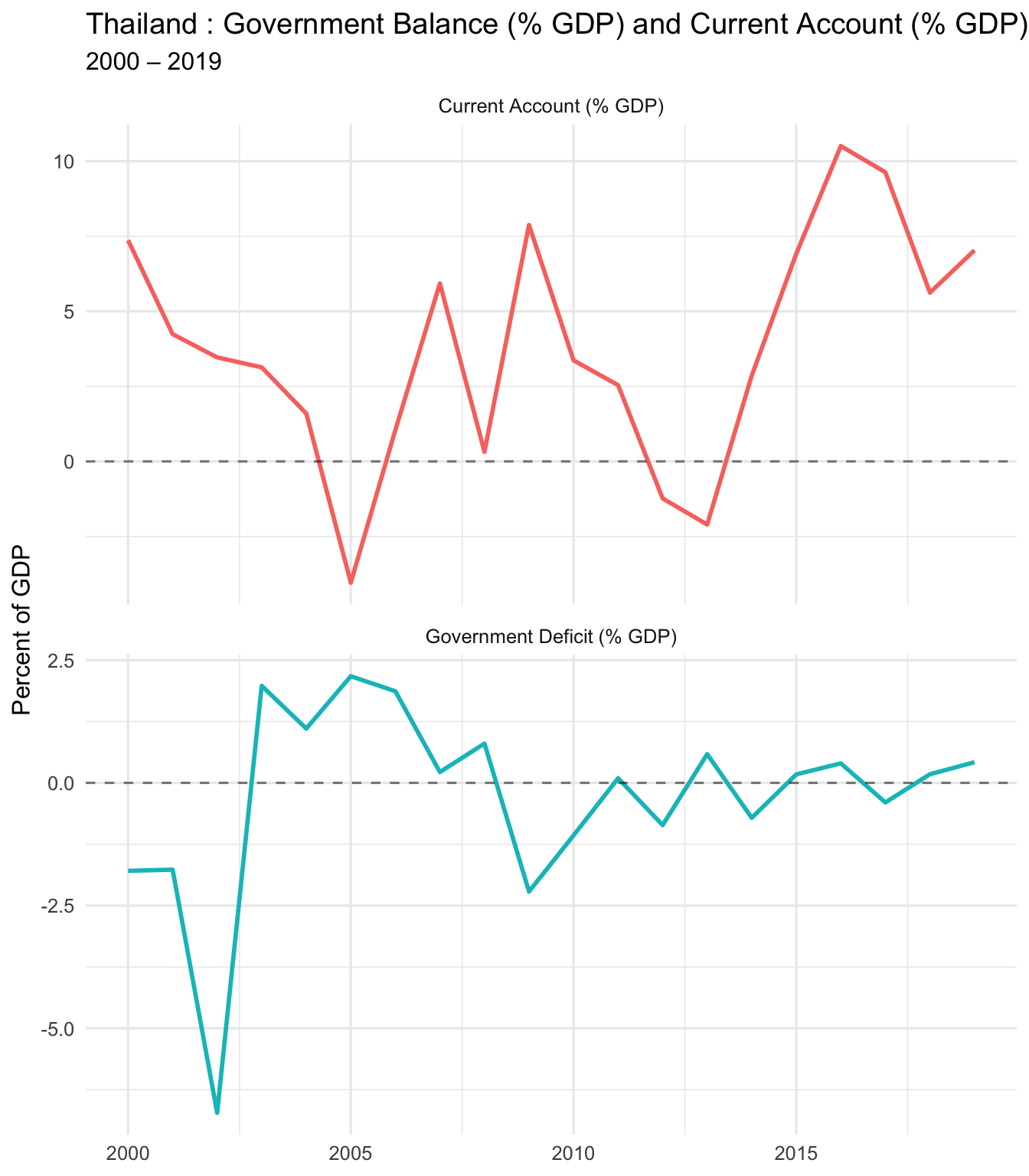

glue("Correlation (Gov Deficit, CA) = {round(cor_govdef_ca, 4)}")Correlation (Gov Deficit, CA) = -0.0825C. As % of GDP

Proj1_govdef_ca_gdp_long <- Proj1 %>%

select(year, govdef_GDP, CA_GDP) %>%

pivot_longer(

cols = c(govdef_GDP, CA_GDP),

names_to = "variable",

values_to = "value"

) %>%

mutate(

variable = recode(

variable,

govdef_GDP = "Government Deficit (% GDP)",

CA_GDP = "Current Account (% GDP)"

)

)

ggplot(Proj1_govdef_ca_gdp_long, aes(x = year, y = value, color = variable)) +

geom_line(linewidth = 1) +

geom_hline(yintercept = 0, linetype = "dashed", alpha = 0.5) +

facet_wrap(~ variable, ncol = 1, scales = "free_y") +

labs(

title = paste(my_country, ": Government Balance (% GDP) and Current Account (% GDP)"),

subtitle = paste(start_date, "–", end_date),

x = NULL,

y = "Percent of GDP"

) +

theme_minimal(base_size = 12) +

theme(legend.position = "none")

PART SIX: Export Cleaned Data

6. Save Your Work

Export the cleaned dataset with all calculated variables.

# Create filename

clean_file <- paste0(

"Proj1_clean_",

gsub(" ", "_", my_country),

"_",

start_date,

"_",

end_date,

".xlsx"

)

# Write to Excel

write_xlsx(Proj1, clean_file)

glue("✅ Exported cleaned data to: {clean_file}")✅ Exported cleaned data to: Proj1_clean_Thailand_2000_2019.xlsxSummary and Key Takeaways

What We Learned Today

- ✅ How to load and filter Excel data in R

- ✅ Current Account = Trade Balance + Income Balance

- ✅ CA = GDP − (C + I + G) (absorption approach)

- ✅ CA = S − I (savings-investment approach)

- ✅ How to create professional time-series and scatter plots

- ✅ How to calculate correlations and interpret them

- ✅ How to use Copilot to speed up coding

- ✅ How to render a Quarto document to HTML/PDF

Student Checklist (What to Submit)

- ✅ Change

my_country,start_date,end_dateto YOUR chosen values - ✅ Re-run ALL code chunks from top to bottom

- ✅ Render to HTML:

quarto render proj1-gmd-live-demo.qmd --to html - ✅ Check that all plots show YOUR country’s data

- ✅ Submit:

- Your rendered

.htmlfile - Your edited

.qmdfile - Your cleaned

.xlsxexport (optional) - Your GitHub repo link (if applicable)

- Your rendered

Copilot Prompts You Can Try

For understanding: - “Explain what the current account measures in plain English” - “Why would a country have a negative current account?” - “What’s the difference between trade balance and current account?”

For coding: - “Add a column that calculates CA as percent of GDP” - “Create a scatter plot with a regression line” - “Write code to export only specific columns to Excel”

For writing: - “Write a paragraph explaining why this country’s CA is negative/positive” - “Summarize the relationship between government deficit and CA in 3 sentences” - “What does a correlation of X mean in this context?”

Resources

- Quarto Documentation: https://quarto.org/docs/

- GitHub Copilot for Students: https://education.github.com/pack

- Positron IDE: https://positron.posit.co

- ggplot2 Reference: https://ggplot2.tidyverse.org

- Your instructor: aman.desai@quinnipiac.edu

Questions?

- Email me with questions: aman.desai@quinnipiac.edu

- Office hours: MoWeFri 3:00-4:15 PM

- Work with classmates!

🎉 Congratulations! You’ve completed the live demo!

Now try changing the country, re-running all chunks, and rendering your own version!

✅ Demo complete! Now customize and render your own version.